MONDAY, JANUARY 10, 2011

Satyajit Das: European Death Spiral – Mission Unaccomplished (Naked Capitalism)

By Satyajit Das, the author of “Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives”

In early 2010, drawing on the military leadership of President George W. Bush, European leaders declared the economic equivalent of “mission accomplished”. A bailout – whoops support! – package of Euro 750 billion had shocked and awed speculators into submission. Like the Bush pronouncement, the European prognosis provided premature. The return of European sovereign debt problems in late 2010, culminating in the bailout of Ireland highlighted the deep seated and perhaps intractable problems of some over indebted European nations.

Mission Interrupted

In the first half 2010, the trigger was the large budget deficits and high debt levels of the “PIGS” (Portugal, Ireland, Greece and Spain) or “PIIGS” (including Italy). For Greece, a lethal cocktail of the need to finance maturing debt and deficits, use of derivatives to disguise debt levels and general lack of candour about its borrowing, exacerbated the problem.

The European Union (”EU”) responded ultimately with a variety of measures, including an Euro 110 billion bailout for Greece and the Euro 750 billion European Financial Stability Funds (”EFSF”) designed to underwrite the liquidity of the besieged Euro-zone members.

The European Central Bank (”ECB”) separately supported the EU measures. The ECB’s role, presumably with the tacit agreement of the EU and members, was crucial, avoiding the problems of lack of consensus and disagreements at the political level.

The ECB purchased bonds issued by Greece, Ireland and Portugal in the secondary market to support prices. By mid-December 2010, the ECB had purchased Euro 72 billion as part of these operations.

More importantly, the ECB supported banks in the troubled companies, providing funding when money markets would not finance these institutions. The funding was at attractive rates (around 1%), against security of government bonds lodged as collateral for the loans. A delicious arbitrage and backdoor way of financing the troubled borrowers ensued.

Domestic banks in Greece, Ireland, Portugal and Spain purchased their own government’s debt, ensuring crucial demand and “successful” auctions. The purchased bonds were used as collateral to secure funding from the ECB. The illusion that the countries had access to commercial funding sources at reasonable rates was maintained. The banks also earned large returns, the difference between the yield on the bonds and the ECB funding rates.

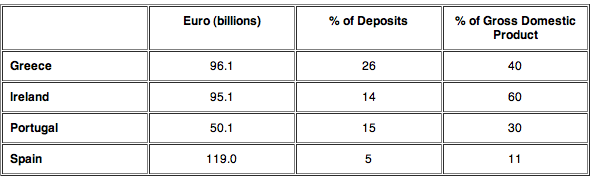

As of August 2010, the level of ECB funding was as follows:

READ FULL POST HERE

No comments:

Post a Comment