THURSDAY, JANUARY 06, 2011

EU Proposes Bank Failure Plan, European Bond Spreads Increase (Calculated Risk)

by CalculatedRisk on 1/06/2011 02:03:00 PM

From the WSJ: EU Proposes Plan for Bank Failure

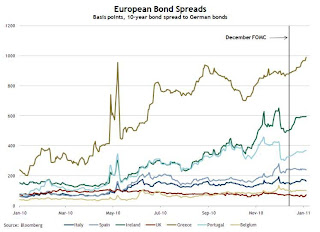

The EU executive arm, the European Commission, Thursday released a hefty 100-plus page consultation paper open to public comments until March 3, which aims to abolish the excuse that a bank is too big to fail. It asks whether bank bond holders should share in paying for future bailouts ...Here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of Jan 4th):

[A] diplomat added: "The overriding objective is to make sure creditors bear the appropriate share of losses of a failing bank and these aren't immediately passed along to taxpayers."

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the Atlanta Fed:

Greek, Irish, and Portuguese bond spreads (over German bonds) continue to be elevated, rising since the December FOMC meeting.READ FULL POST HERE

Since the December FOMC meeting, the 10-year Greek-to-German bond spread has widend by 105 basis points (bps) (from 8.85% to 9.90%) through January 4.

No comments:

Post a Comment