The Bankwatch

Tracking the evolution of financial institutions

Goldman Sachs derivative liability = 33,823% of assets

with 8 comments

I have spoken at length here about the insidiousness of derivatives and Credit Default Swaps. So this new statistical reference frankly awed me. It is from a Levy paper on the recent shift over the last 50 years to a shadow banking system, that has largely replaced bank balance sheet lending with Money Managers. As I read this paper, while I am also reading ‘This Time is Different – eight centuries of financial folly’, there is little to feel good about in the apparent economic rebound that the government keeps telling us about.

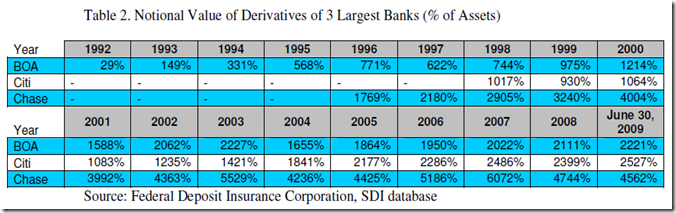

The data on derivatives is impressive. JPMorgan Chase, for example, held derivatives worth 6,072 percent of its assets at the peak of the bubble in 2007. The other two giants, Citigroup and Bank of America, although still far behind Chase, had 2,022 percent and 2,486 percent respectively. Goldman Sachs, the other giant, had an astonishing amount of derivatives on its balance sheets: 25,284 percent of assets in 2008 and 33,823 percent as of June 2009. Citigroup and BOA now have more of this risk on their books than before the crisis (FDIC SDI database).

The part that awed me, is that BofA and Citi now have more derivative exposure than they did in 2007! Huh! What is Timothy Geithner being paid for? I have to admit after TARP and the apparent hands on approach I like most assumed things were being fixed, but apparently not.

This simply adds to the point that despite all the histrionics and efforts in Washington, nothing has been learned and the American Banking system is now at least at as much risk now as in 2007, pre crash.

Incidentally when trying to understand derivatives, simply assume off balance sheet debt. There is all kind of rationale as to why that off balance sheet debt is not dollar for dollar, but the important point is that no-one argues that derivatives are worth zero. There is an intrinsic liability that frankly few bankers can explain to you, so you must begin with the face value of the liability, and banks are guilty until proven innocent on that one.

As an accountant, the notion of off balance sheet debt is a contradiction in terms. Is it a liability? If yes, it should be on the balance sheet.