Bulls Willing to Do Anything to Avoid Falling into Market Abyss

Jun 10, 2010: 11:31 AM CSTI think all of us chart watchers are focused intently on the epic Battle of 1,040, but I wanted to pull the perspective back for those who aren’t as accustomed to studying charts to show exactly why the market is balanced “on the Edge of a Cliff” and why the bulls holding above key support here is of utmost importance to them.

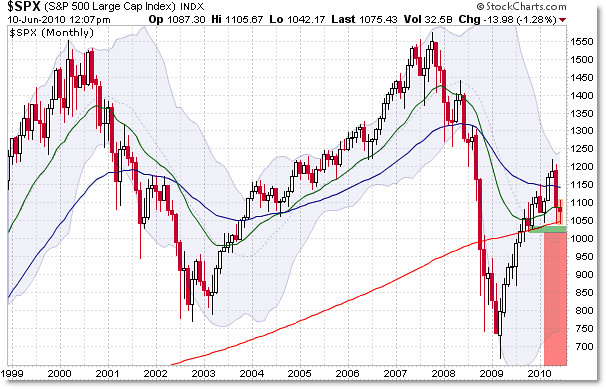

Let’s start first with the Monthly Chart and build down from there:

The 200 month simple moving average – the last line of support from a multiple timeframe moving average perspective (that just means looking at moving averages for potential support zones on three timeframes) rests at 1,048.

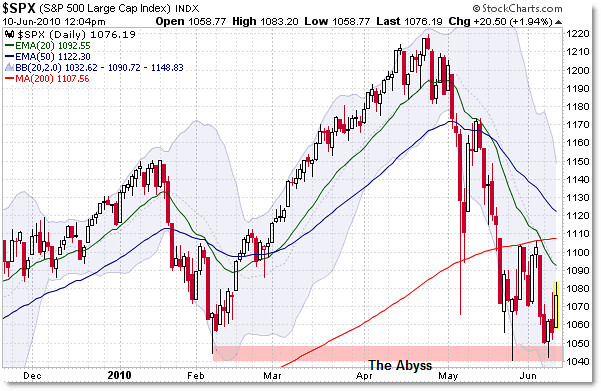

As chartists, we hold prior price lows as important expected support levels, and those include:

1,044 from February 2010,

1,040 from May 2010

1,042 from June 2010

1,040 from May 2010

1,042 from June 2010

then also

1,029 from November 2009

1,019 from October 2009

1,019 from October 2009

In terms of standard analysis, there is nothing major in the way of support under these levels except the round number 1,000.

I think the Weekly Chart probably shows the “Abyss” most clearly:

We can see all the price lows that form the boundary or the quite literal “Edge of the Cliff” for the market.

The edge is here, and the final level is 1,000. Under that, we’re looking to the July 2009 low at 850 as the next potential support zone.

And if we’re under 850, we look back to 666. That’s just using simple technical analysis – nothing complex.

Keep in mind we are under all moving average levels – the waving lines on the chart – which now are expected to be resistance – no longer support

Notice how price bounced off these averages on the way up in 2009 and fell down from these levels on the way down in 2008.

Finally, here we are at the Edge of the Cliff:

The fact that we see three LONG lower shadows in February, May, and June underscore to me how seriously the market participants take this level.

They’re willing to do anything possible to keep the market above these levels. As long as we’re above them, it’s like were looking down into an abyss, and it’s dangerous to look over the edge of the cliff, but just because you’re at the edge doesn’t mean you’re going to fall over.

However.

If the market does fall over the cliff, it will be far more difficult to support the market than it would be above the level.

It’s like trying to catch a person who’s leaning over the edge and pull him back over, or trying to catch him as he’s falling.

I cannot underscore how important it is to monitor the current level extraordinarly closely – from whatever perspective or position you have.

From a simple charting/technical analysis perspective, there is nothing – chart wise – to hold up this market from a likely downturn into a new downtrend if bulls lose the battle of 1,040 (then 1,000).

Corey Rosenbloom, CMT

Afraid to Trade.com

Afraid to Trade.com

No comments:

Post a Comment