November 11, 2010 – The Mad Hedge Fund Trader Interviews Karl Denninger of Market Ticker (Diary of A Mad HedgeFundTrader)

The Mad Hedge Fund Trader Interviews Karl Denninger [40:00m]: Hide Player | Play in Popup | Download

The Mad Hedge Fund Trader Interviews Karl Denninger [40:00m]: Hide Player | Play in Popup | Download

Featured Trades: (KARL DENNINGER ON HEDGE FUND RADIO),

(ONLY BUY COMPANIES YOU HATE),

(SPX), (INDU), (BAC), (C ), (JPM), (WFC),

(AAPL), (GOOG), (QQQQ),

(BP), (GS), (C), (PFE), (MO)

(ONLY BUY COMPANIES YOU HATE),

(SPX), (INDU), (BAC), (C ), (JPM), (WFC),

(AAPL), (GOOG), (QQQQ),

(BP), (GS), (C), (PFE), (MO)

1) Karl Denninger of Market Ticker on Hedge Fund Radio.

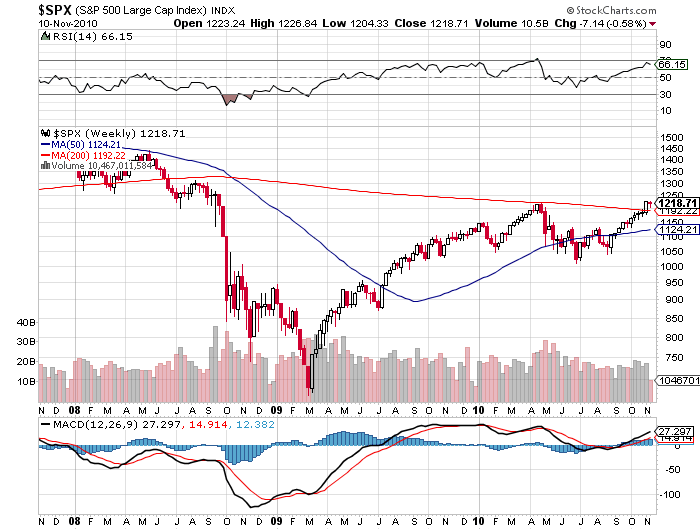

Karl Denninger of Market Ticker thinks there is a secondary banking crisis around the corner that will trigger a cascading collapse in the stock market, and another government bailout. TARP 3 anyone? We could reach 3,000 in the Dow and 300 in the S&P 500.

This is one of many controversial and incendiary opinions about the state of the global financial markets Karl voiced to me in a wide ranging interview onHedge Fund Radio. Karl says the idea that we are going back to an S&P 500 of $105-$110 in the face of the soaring cost input factors is totally laughable.

Bernanke is making the same mistake we saw in 1933. The nightmare scenario for him is a coincident dollar and stock market selloff. The risk of hyperinflation will force him to back off on easy money. If the market goes up by 30% and the dollar devalues by 30%, then you haven’t made any money. When cost push pressures show up, corporate earnings are going to disappear. Companies like Kimberly Clark are reporting the largest raw material cost increases in history. Even Apple is seeing cost push problems.

“Foreclosure Gate” will be much worse than expected. There is upwards of $200 billion worth of exposure just on the “put back side”. The large banks also have second line exposure on their own balance sheets that is at least as big, if not bigger. In dollar terms, interest income has been good, but their spreads have been collapsing.

Banks problems may become impossible to hide in 3-6 months. They are passing around the losses trying to hide the truth. Banks made their earnings in the recent quarter by taking down reserves. Not providing for these risks is absolute fancy.

The 900 pound gorilla in the room is the second line problem, which is mostly concentrated in the top banks, including (BAC), (C ), (JPM), (WFC). Industry wide, only $1 trillion of $3.5 trillion in real estate losses has been realized, and at some point, someone is going to have to swallow. Wells Fargo is the most leveraged, could be the first to go, with $1 trillion in off balance sheet exposure, including all of the garbage they took in from Wachovia.

Are you wondering why financials have done so poorly this year? Investors are still laboring under the false premise that these firms are too big to fail and that the government won’t let anything bad happen to them. It is assumed that in the worst case, they will see flat earnings and no EPS growth for the next couple of years. Karl thinks that is incredibly naïve. The big pension funds that own most of these stocks are going to get hosed.

The majority of money has been made in the bond market. Karl hates to buy near a top.

Commodities are starting to look scary. The “softs” have delivered parabolic moves which never end well. Oil breaking through $100 could be the triggering event for the corporate margins crash which takes the stock market down. Break $87 and it’s off to the races. This will cause tremendous damage to the economy. Then bring in the “RISK OFF” trade, because everything will go down, starting sometime in 2011.

Until then, you can day trade, play in the futures market, and make plenty of money. Just keep everything on a tight leash. Stay away from positions that are hard to get out of. Dollar strength could be the key triggering event. Europe could also be another. And then there are potential black swan events, like state attorney generals halting the foreclosure process.

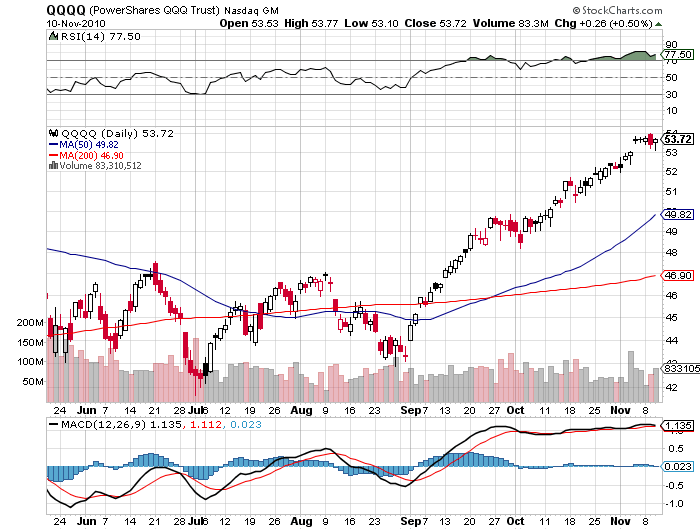

Karl believes the technology sector is very over extended. Apple (AAPL) is now 20% of PowerShares QQQ Trust (QQQQ). Apple’s success is attracting competition. Google Android sales have suddenly rocketed, a tectonic ship for the market. LG and Samsung are more attractive than Google (GOOG) or Apple, because they supply the processors and screens. Intel at $20 doesn’t look bad, especially if it breaks the 200 day moving average to the upside. In so many areas in the tech world, he loves the companies but hates the prices.

Karl Denninger is the publisher of the daily blog, Market Ticker. He was the CEO and one of the founders of MCSNet, a Chicago area Internet and networking company which he sold in 1998. Since then, Karl has been a successful independent trader. In 2007, he started posting Market Ticker, a highly entertaining and prescient, if not irreverent daily blog. He also createdTicketForum, an online trading forum. In 2008, Karl received the Reed Irvine Accuracy In Media Award for Grassroots Journalism for his coverage of the market meltdown. To learn more about Karl Denninger, you can visit his website at http://market-ticker.org/ . To listen to my lively interview with Karl on Hedge Fund Radio in full, please click here.

Does Anyone See 300 Here?

Does This Look Overextended to You?

1 comment:

I bookmarked it and I will check your site later again.

Best Regarding.

Mutual Funds

Post a Comment