WEDNESDAY, AUGUST 7, 2013

Stephanie Kelton: Reading Between the Lines – A Memo from Fed Chairman Marriner Eccles

Yves here. Even though there are some news stories that might merit comment, economists and finance people often have an inadequate appreciation of history. Stephanie Kelton does an important service in discussing a memo from the Fed chairman during the Roosevelt Administration, Marriner Eccles. I was reminded of Eccles’ a fine appreciation for how the real economy worked and how government actions affected business. This keen eye for the fundamentals is sorely absent among most macroeconomists and policy experts today.

By Stephanie Kelton, Associate Professor and Chair of the Department of Economics at the University of Missouri-Kansas City. Cross posted from New Economic Perspectives

After I shared a few thoughts on the impending decision to replace Ben Bernanke as Chairman of the Federal Reserve, I couldn’t help revisiting the writings of Marriner Eccles. Eccles was a Republican and a businessman who, by the age of 22, had become a millionaire with an impressive record of restructuring and consolidating balance sheets (including those of financial institutions) to withstand the turmoil of the Great Depression. In 1934, Franklin D. Roosevelt tapped Eccles to head the Federal Reserve, a position he held until 1948.

The following memo – written May 19, 1938 – gives you a flavor of the way Eccles thought about important issues related to financial stability and macroeconomic policy. What he doesn’t say is at least as important as what he does. For those who struggle with econo-speak, my own plain-speak is interspersed throughout.

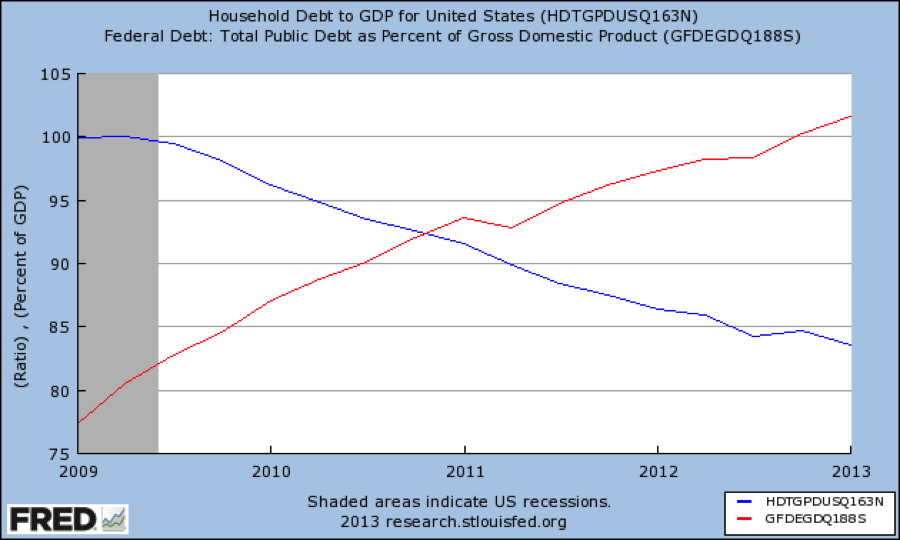

As a general principle, deficit-spending by the government should only be undertaken in depressed times as a means of offsetting in part or compensating for the lack of private activity. Conversely, when private debt is rapidly expanding, there should be a contraction of public debt as a counterbalancing and stabilizing influence.

KELTON: The government is a partner in the economy. When the private sector tightens its belt (i.e. borrows and spends less money), it is fiscally responsible for the government to compensate by loosening its belt. (This, by the way, is exactly what ended the Great Depression and, more recently, what halted the Great Recession.)

READ FULL ORIGINAL POST AND MORE HERE

No comments:

Post a Comment