Watch Out for the “Anti-Growth” Trade!

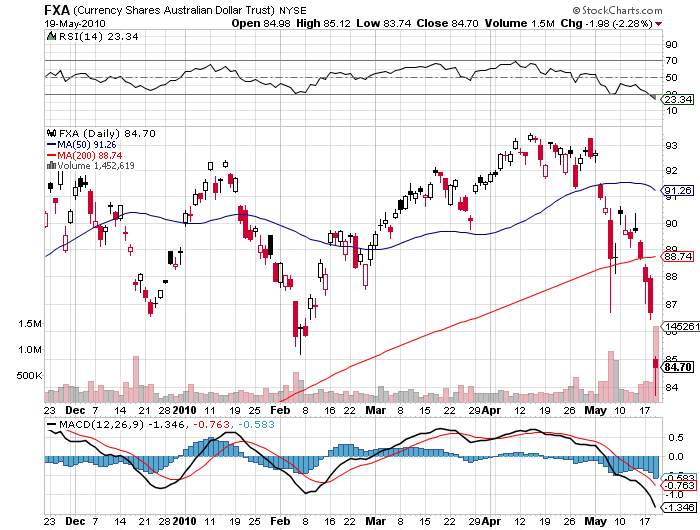

Now that most big hedge funds have completed their race to get neutral, they are holding raucous in-house debates over placing size bets on a double dip recession. This would involve reversing every trade that I have been recommending for the past 18 months, in which the hedge funds have also been running gargantuan positions, flipping from longs to shorts. On the table are new shorts in commodities, energy (USO), emerging markets (EEM), the industrial white metals of silver (SLV), platinum, (PPLT) and palladium (PALL), junk bonds (JNK), and corporate bonds. This view has traders going long the dollar and the yen (YCS) and shorting the euro (FXE), pound (FXB), and the commodity producing Australian (FXA) and Canadian dollars (FXC). Long positions would be established in the dollar, Treasury bonds, and volatility (VIX). This is not exactly a low risk trade, as it goes contrary to every long term global macro trend currently in place. If you get the double dip recession that Europe, China, and more recently, British Petroleum (BP) are trying their best to deliver, they hit a home run. If the recent diabolical market action turns out to be just a vicious head fake, then they would be selling into a hole and getting killed on the next whipsaw. They don’t call these guys the Masters of the Universe for nothing. Suffice to say that you should only entertain such a position if you run a global 24-hour trading desk, have a blind former frat brother for a margin clerk, and a Harvard educated legal department to make up the appropriate excuses when things blow up. Three year lock ups on client funds would also be good to have. If you don’t have all of this in place, then better to just read about it in the tabloids. The Internet is a great leveler, and enables legendary hedge fund trader, Paul Tudor Jones, and his 300 man staff to compete head to head against you. I can tell you who will win that one every time. I can’t wait to see who actually straps this one on.

|

No comments:

Post a Comment