TUESDAY, OCTOBER 25, 2011

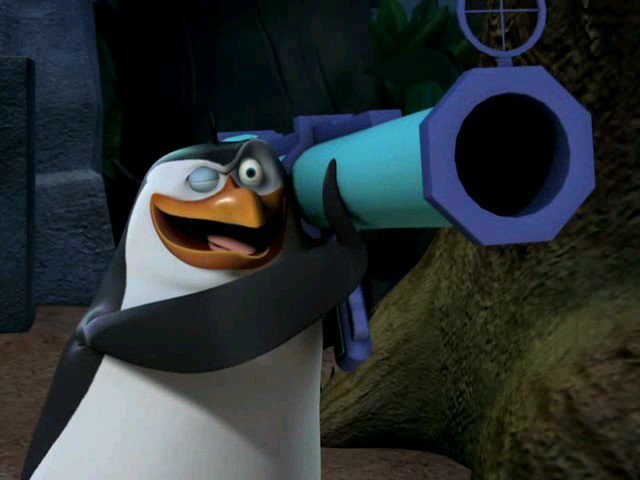

Europe Readies Its Rescue Bazooka

It’s one thing to fail to recall relevant events that are genuinely historical, quite another to refuse to learn from recent failed experiments.

Remember Hank Paulson’s bazooka? The Treasury secretary, in pitching Congress to give him authority to lend and provide equity to Fannie and Freddie, argued, “If you have a bazooka in your pocket and people know it, you probably won’t have to use it.”

but the Treasury’s new powers did not do the trick. Less than two months later, Treasury and OFHEO put the GSEs into conservatorship.

If the latest rumors prove to be accurate, the latest Eurozone machinations make Paulson look good. The Financial Times reports that the Greek deal is being reworked, with bondholders being “asked” to take 60% haircuts. The critical bit is the word “asked”. Recall this restructuring is supposed to be voluntary to avoid triggering a credit event under credit default swaps. The old deal with a mere 21% haircut, had a takeup below the 90% sought and the 80% deemed the minimum acceptable. With haircuts this deep, how pray tell will the authorities force banks to go along with an allegedly voluntary deal? Any party that was hedged is going to want to see a bona fide default so he can cash in his credit default protection. But Greek banks were big protection writers (why anyone would accept them as counterparties is beyond me), so breaking them (which is what I assume would happen) would necessitate bailouts by the broke Greek state, which would worsen the national insolvency, which is what the deeper haircuts were supposed to avoid.

No comments:

Post a Comment